On the First 5000. Surcharge P90000 x 25 tax rate P240000.

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Tax ID 46-4664562 One Tree Planted is a 501c3 tax-exempt organization and your donation is tax-deductible within the guidelines of US.

. Malaysia follows a progressive tax rate from 0 to 28. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information. Malaysia used to have a capital gains tax on real estate but the tax was repealed in April 2007.

It was established to deliver measurable value to the particular demands of. A specific rate of tax of RM25 is imposed upon issuance of principal or. Learn more FINANCIALS 2019 Form 990.

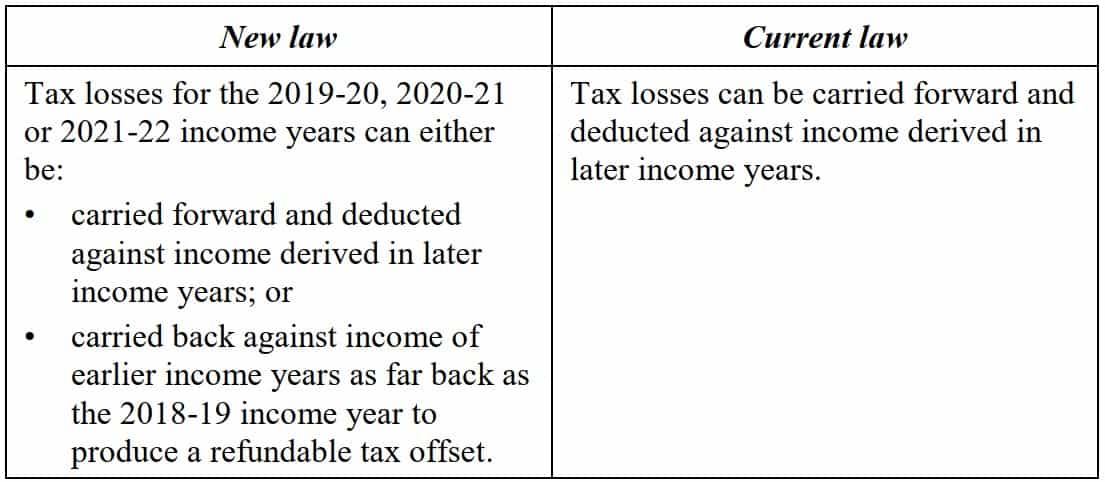

Any assessee whos advance tax liability is more than Rs. Stage of company early-stage seed or Series A rounds. Tax on imported services will be carried out in 2 phases services imported by Malaysian businesses from 1 January 2019 while services imported by Malaysian consumers from 1 January 2020.

An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. 122019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. 5 4 cess.

View flipping ebook version of 475929704-Income-Tax-2019-Banggawan-SolMan-pdf published by busaingchristina001 on 2020-10-02. 13 December 2019 _____ Page 4 of 13 Example 2 The facts are the same as in Example 1 except that the exchange rate on 1562019 was RM440 USD1 and the RM equivalent for USD10000 was RM44000. Tax Rate FY 2019-20 AY 2020-21.

Tax Rate FY 2018-19 AY 19-20. The tax paid by the company on the income earned is known as corporate tax and is mentioned as income tax for companies in challan. Company Taxpayer Responsibilities.

Poverty rate of rural and urban areas in Malaysia 2007-2019. However a real property gains tax RPGT has been introduced in. Malaysia Company Incorporation Services.

Tax Rate of Company. However from 1 January 2020 foreign service providers of digital services to consumers in Malaysia exceeding MYR500000 per year will be liable to register for Service Tax. Some banks offer attractive low-interest-rate loans for small businesses backed and guaranteed by the U.

As per Section 224 of The Companies Act 2013 company secretary or secretary means a company secretary as defined in clause c of sub-section 1 of section 2 of the Company Secretaries Act 1980 who is appointed by a company to perform the functions of a company secretary under this Act. Up to 25 lakhs. A finance company earned P1000000 royalties from a franchise.

Company with paid up capital not more than RM25 million. Rate TaxRM A. Indonesian Tax Guide 2019-2020 3 Contents About Deloitte 4 General Indonesian Tax Provisions 7.

The Service Tax rate is fixed at 6. Tax Rate of Company. Dec 22 2019 0347pm EST.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. 40 of these were derived abroad.

Tax Rate of Company. A Latvian company can reduce the tax base by the capital gains the company has earned from the sale of shares if the Latvian company has held those shares for at least 36 months. PPF Interest Rate 2022- All You Need to Know.

Public Provident Fund PPF is a government-initiated tax-saving investment option used by the citizens of India. On the First 5000 Next 15000. PPF was introduced in 1986 by the National Savings Institute of the Ministry of Finance to initiate savings in form of investment along with the benefit of return on it.

On the other hand the tax paid by the non-corporate. Lao PDR Malaysia Myanmar Philippines Singapore Thailand and Vietnam. B P22100 X 20 surcharges shall be P240000 x 2.

Tax deducted at source TDS Tax Collected at source TCS and Minimum Alternate Tax MAT credit shall be deducted to arrive at Advance Tax Liability. Company DB New. Prices do not include sales tax.

A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. Currently an overseas company with no permanent establishment in Malaysia would not be liable to register for Sales Tax or Service Tax. The exchange rate had varied to the disadvantage of the company and this.

Public Provident Fund can also be called a.

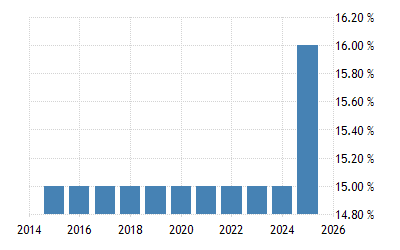

Lithuania Corporate Tax Rate 2021 Data 2022 Forecast 2006 2020 Historical

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Italy Government Debt To Gdp 2019 2022 Statista

Taxplanning Tax Measures Announced During The Mco The Edge Markets

Why Mauritius Is The 2nd Fastest Growing Wealth Market After China Growing Wealth Wealth Economic Trends

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

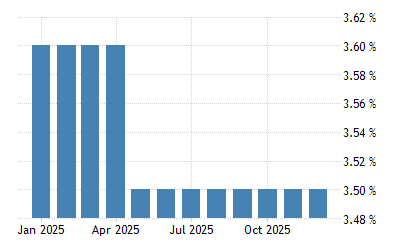

China Loan Prime Rate 5y May 2022 Data 2019 2021 Historical June Forecast

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com Investing Property Investor Investment Property

10 Things To Know For Filing Income Tax In 2019 Mypf My

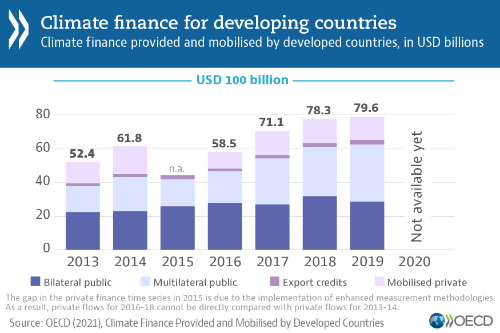

Climate Finance Provided And Mobilised By Developed Countries Aggregate Trends Updated With 2019 Data En Oecd

Sme Corporation Malaysia Sme Corp Malaysia Quarterly Survey

2019 Q4 And Full Year Results Presentation Transcript Novartis

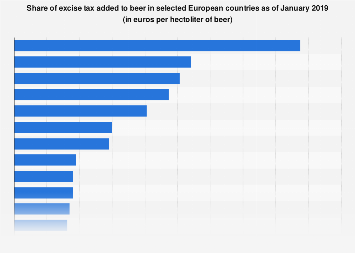

Beer Excise Rates By Country 2019 Statista

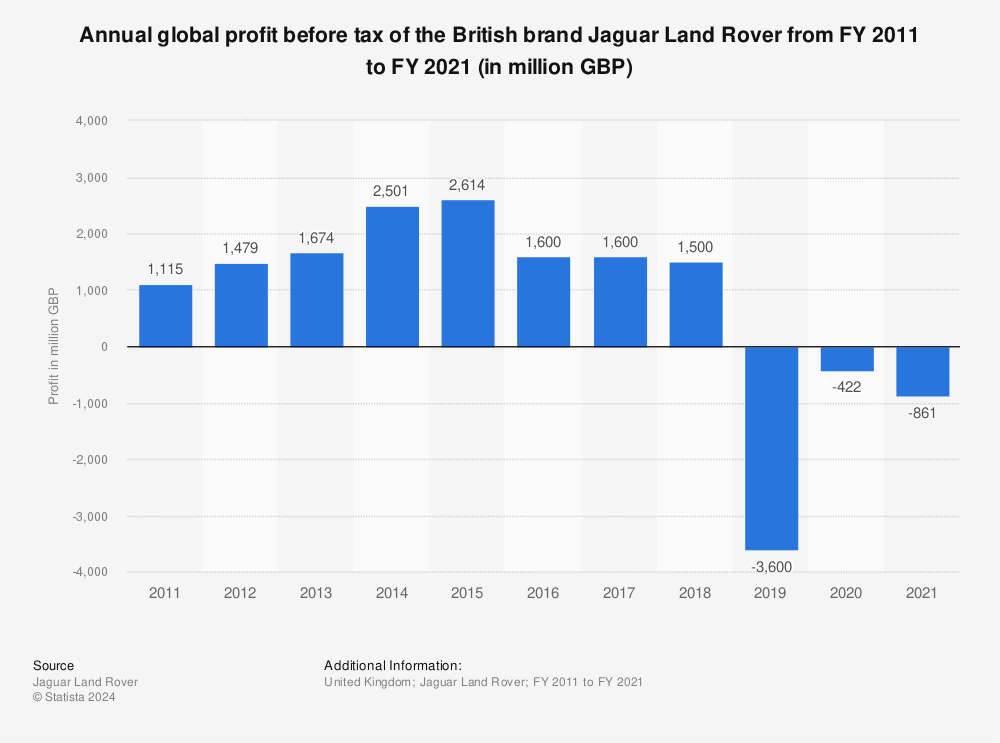

Jaguar Land Rover Profit Before Tax 2011 2021 Statista

Awesome Depreciation Tax Shield In Hire Purchase Is Claimed By In 2022 Hire Purchase Hiring Tax

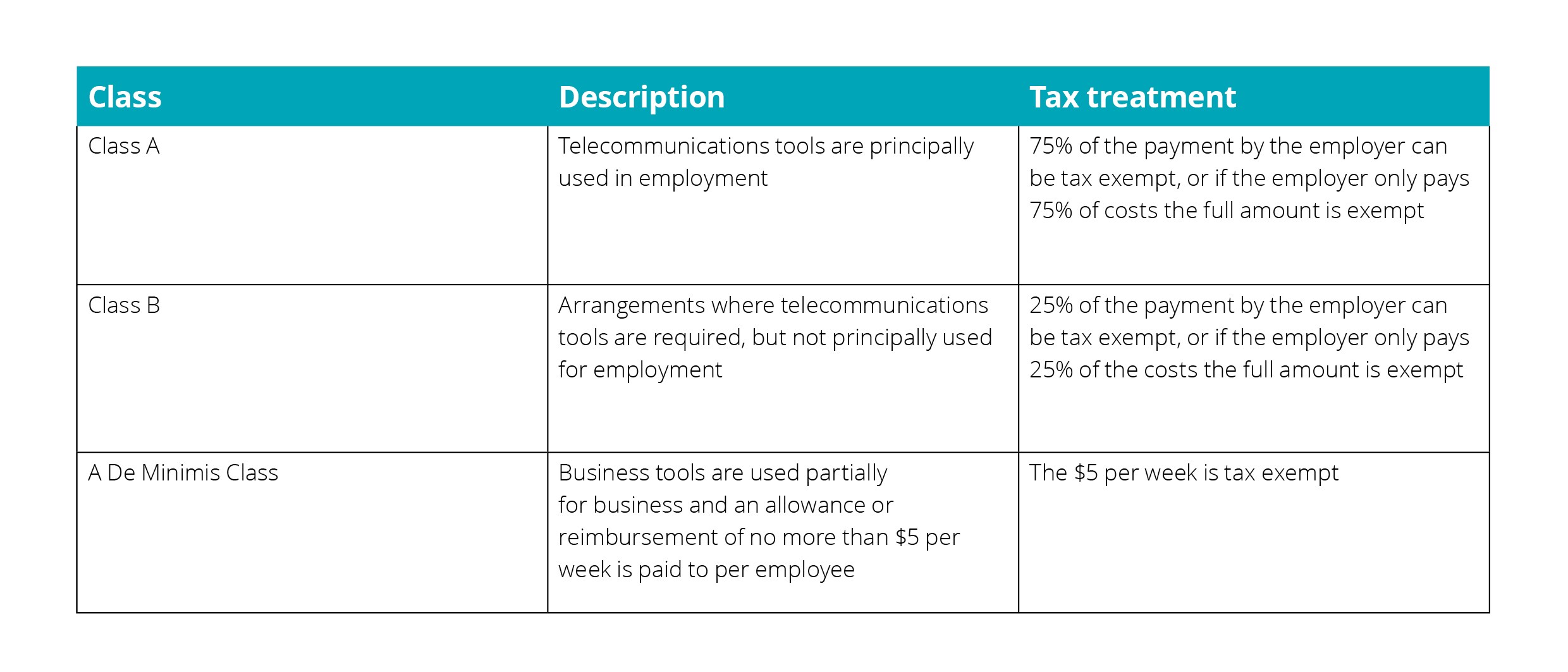

Taxing Telecommunication Tools September 2019 Tax Alert Deloitte New Zealand

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Company Tax Rates 2022 Atotaxrates Info